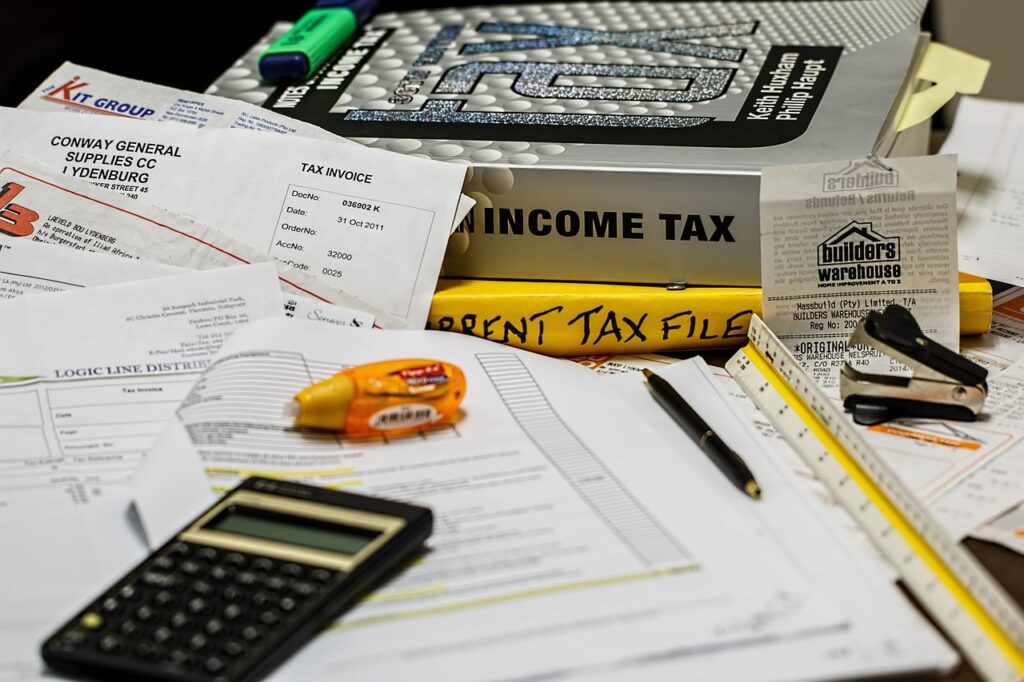

When it comes to real estate investing, understanding the impact of taxes on your investment returns is crucial. One important metric to consider is the Sales Proceeds After Tax (SPAT), which provides a clear picture of your net earnings from a real estate transaction.

What is Sales Proceeds After Tax (SPAT)?

Sales Proceeds After Tax (SPAT) is the amount of money you will receive after selling a real estate investment property and paying all applicable taxes. It represents the final, net amount you will have in your pocket after the sale, excluding any financing or loan-related costs.

Calculating SPAT Without Financing

To calculate SPAT for a real estate investment property sold without any financing, follow these steps:

- Determine the Selling Price: This is the amount for which you sold the property.

- Calculate the Adjusted Basis: The adjusted basis is the original cost of the property, plus any capital improvements made, minus any depreciation deductions taken.

- Compute the Capital Gain: The capital gain is the difference between the selling price and the adjusted basis.

- Estimate the Capital Gains Tax: The capital gains tax rate depends on your individual tax situation, but it is typically 15% for most taxpayers.

- Calculate the SPAT: SPAT = Selling Price – Capital Gains Tax

For example, let’s say you purchased a real estate investment property for $300,000, made $50,000 in capital improvements, and took $75,000 in depreciation deductions. If you sold the property for $500,000, your SPAT would be calculated as follows:

- Selling Price: $500,000

- Adjusted Basis: $300,000 + $50,000 – $75,000 = $275,000

- Capital Gain: $500,000 – $275,000 = $225,000

- Capital Gains Tax (15%): $225,000 x 0.15 = $33,750

- SPAT: $500,000 – $33,750 = $466,250

Importance of Calculating SPAT

Calculating SPAT is important for several reasons:

- Tax Planning: Understanding the tax implications of a real estate sale allows you to plan for the appropriate amount of taxes owed and potentially explore strategies to minimize your tax liability.

- Investment Analysis: SPAT is a crucial metric in evaluating the overall profitability of a real estate investment, as it represents the net amount you will receive after the sale.

- Cash Flow Management: Knowing your SPAT can help you plan for reinvestment, debt repayment, or other financial goals.

- Comparison of Investment Opportunities: Calculating SPAT allows you to compare the net returns of different real estate investments, enabling you to make more informed decisions.

Conclusion

Calculating Sales Proceeds After Tax (SPAT) is a crucial step for any real estate investor or seller. It provides a clear picture of the net profit from a real estate transaction after accounting for all applicable taxes and costs. By understanding SPAT, you can make more informed decisions, plan your investments better, and optimize your financial outcomes.

In the real estate industry, where every dollar counts, knowing your SPAT helps you evaluate the true profitability of your investments. This knowledge allows you to strategize effectively, whether you’re selling a property to reinvest elsewhere, retire debt-free, or maximize your return on investment.

To ensure accuracy in your calculations, consider consulting with a real estate tax professional or financial advisor. They can help you navigate the complexities of tax laws and provide personalized advice based on your unique financial situation and investment goals.

For expert guidance on calculating SPAT or any other real estate investment queries, feel free to contact us. Our team is dedicated to helping you achieve your real estate investment objectives with confidence and precision.